By : SHWETA BHANOT MEHROTRA

MUMBAI :

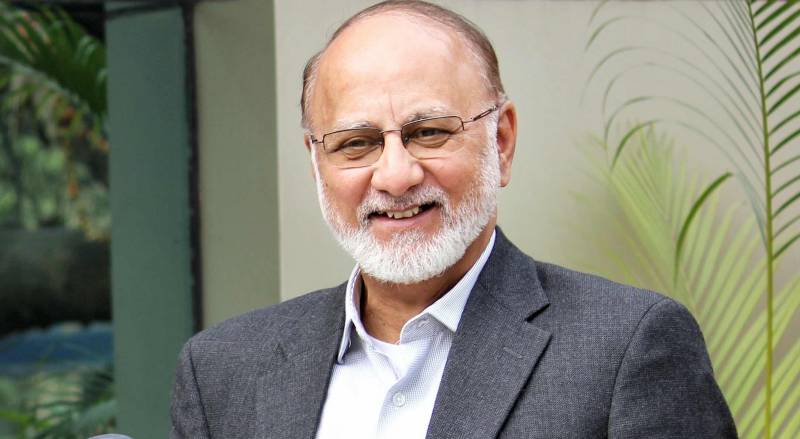

The Indian Electric Vehicle (EV) market has grown by 20% in FY20 over the last year. Electric scooters have contributed towards 97% of the growth. In a telephonic interview, Sohinder Gill, Director General, Society of Manufacturers of Electric Vehicles (SMEV), says that despite the industry expected to lose out six to seven months due to the pandemic, EVs will have a defining FY21 with no de-growth.

TOS: A 20% growth in EV sales is promising in FY20. How do you see FY21 panning out considering the COVID-19 pandemic will create a challenging environment for the entire automotive industry?

SG: Earlier, electric two-wheeler and car makers were thinking of doubling their figures this year (FY21). But I believe now with six months or not, they would be doing as much as they did in FY20. There would not be any de-growth. The growth in E-Buses depends upon the government decisions. In FY20, the EV industry sold 156,000 electric vehicles. Out of this, 152,000 were two-wheelers, 3400 cars and 600 buses. There has been a 20% growth over the corresponding year (FY19) with 126,000 two-wheelers, 3600 cars and around 400 buses, making a total of 130,000 units.

Meanwhile, E-Rickshaws that are still largely unorganized, are expected to grow at faster levels this year. The segment reported sales of around 90,000 units in FY20.

TOS: It is interesting to see that personal mobility in the form of low speed electric scooters have taken the lead in the EV transition. What is your take on this trend? Do you think this would continue over FY21 with the pandemic, and with people choosing personal mobility over public transport?

SG: We have been trying to tell the government that equal performance two-wheelers is a good thing to have but when a buyer goes out to buy, pricing becomes key in terms of their buying decisions. Many like the high-performance electric two-wheelers in the market but do not end up buying them because of the pricing and that is when they move to low speed and more affordable options available in the market. Now, post this pandemic, many people would be looking for personal mobility over public transport, as they would want to travel on their own electric two-wheelers than a metro or bus. And in the electric two-wheelers, they would want to go for a product that is light on their pocket. Hence, they would go in for entry to mid-level electric two-wheelers, which include the ones that do not require registration with a maximum speed of 25 km/hr and the ones that need license with a maximum speed 35-40 km/hr, and are non-subsidised. In the electric two-wheelers sold in FY20, 97% were electric scooters and a very small volume of motorcycles and electric cycles filled the rest of 3%. Low-speed scooters that go at a max speed of 25km/hr constituted a whopping 90% of all the electric two-wheelers sold in FY20.

TOS: Which are the markets within India that are leading the EV growth?

SG: There has been a shift in demand. Earlier, the demand was concentrated in metros and main cities, however now we are seeing smaller towns and cities leading in demand. There are a slew of factors leading to this demand growth, specifically for electric two-wheelers in smaller towns and cities. These include absence of a good public transport, short travel distances, fewer petrol pumps and inadequate maintenance outlets. All this works in favour of electric two-wheelers.

TOS: How do you see battery swapping enabling the EV transition? What is the update on inclusion of swapping in FAME II?

SG: Discussions are still on vis-à-vis the inclusion of swapping in FAME II. Battery swapping is a very good idea for B2B because they are long distance users. They can have swapping stations at their warehouses and can make it readily available to their fleets.

But when it comes to retail, it is very difficult to start with, unless the density of swapping station is so high like a petrol pump or even more. It is only then that battery swapping becomes successful. The affordable and mid-segment users typically cover 30-40 kms per day, and the swapping companies find it very difficult to get revenue from them as the charges are very high and they are not willing to pay it. So, for long distance, heavy and B2B users, swapping is a good idea; but for retail, it would take time. It would take around two to three years for swapping to become popular in some parts of the country.

TOS: We have seen BPCL, IIT Madras and Kinetic Green Energy and Power Solutions, announce their partnerships whereby they are making battery swapping available to EV buyers. Will we see more of such partnerships in the future?

SG: Swapping can only be done through partnerships where the properties are available, whether it is dealers, petrol pumps or some distribution chains. For instance, in Taiwan there are 24*7 food stores that have entered into swapping partnerships. There has to be a partnership, otherwise swapping will not work - at least for B2B. We will see a lot of partnerships happening, and setting up of franchisees or partner stores.

TOS: With China a concern market now, how do we see it impacting our EV program and other opportunities derived while going through this challenging situation?

SG: Luckily, many of the players have localised most of their products, including [parts of the] batteries over the past year. Other than motor controller and good quality batteries, most of the components are ‘Made in India.’ However, cells are still imported from China. Even if it is Made in India, it is 60% China and it would continue to be China until we start making cells in India. And this is not going to happen in the next three years. Battery is a major part and cost of the EVs.

While at overall level mechanicals, shock observers, suspensions and braking systems will be localised in FY21, motor controllers will get localised next year. However, cells will be localised only when some manufacturers of cells or some business house takes the lead and sets up a factory for lithium cells in India. It is not an automobile job (OEM), but needs to be made by component maker.

The entire world depends on China for cells, however, in the current situation, we can look at Europe or US but the latter has its hands full. Imports will continue from China but government might increase the import duty. Already, imports on batteries increased by 5% a few months back, and this is another way to push Indian manufacturers to economically produce batteries here rather than import from China.

|

Category |

FY20 (in units) |

FY19 (in units) |

Growth (%) |

|

E-2W |

152,000 |

126,000 |

|

|

E-Cars |

3400 |

3600 |

|

|

E-Buses |

600 |

400 |

|

|

Total |

156,000 |

130,000 |

20% |

Source: SMEV

*This figure does not include E-Rickshaws which is still largely with the unorganized sector with a reported sale of around 90,000 units. The corresponding figures of the E-Rickshaws sold in the previous year have not been documented.